Preparing for IGCSE Accounting paper can be a daunting task. More so since most teachers do not spend enough time ensuring the students master double entry before moving on to other topics. This fundamental flaw compounds the problem further when students are at lost with other topics.

It is understandable that in all the humanities subject, IGCSE Accounting has the highest drop rate. The most number of students get cold feet and drop the subject before the exam registration. How do you avoid the same situation from happening to you? I am going to share three things that you should do to guarantee your A*.

1. Mindset Transformation

First and foremost, you need to transform your mindset. You need to set clear and achievable goals based on the timeline in front of you. You need to start practicing the winner’s mindset. You need to be sure you are going to get this done, no matter how hard the going gets or how long it takes you to practice. Having this mentality alone can help you gain an insane amount of advantage in your preparations for IGCSE Accounting papers.

2. Syllabus Mastery

Next, you need to work on mastering the syllabus. For this, you would need to become familiar with two documents provided by Cambridge Assessment International Education (CAIE) for IGCE Accounting, namely :

A) IGCSE Accounting Learner’s Guide

B) IGCSE Accounting Syllabus

A) IGCSE Accounting Learner’s Guide

As the name suggests, this is a pivotal document that every IGCSE exam candidate must be introduced to at the beginning (the earlier, the better) of their IGCSE journey.

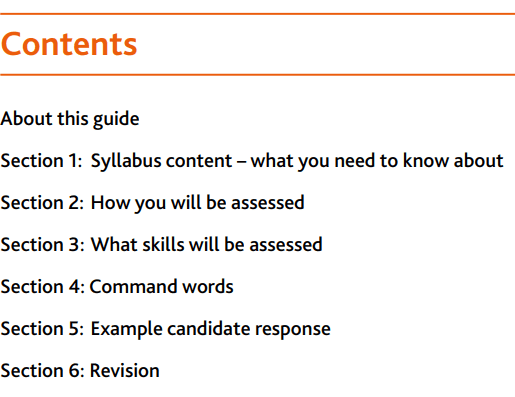

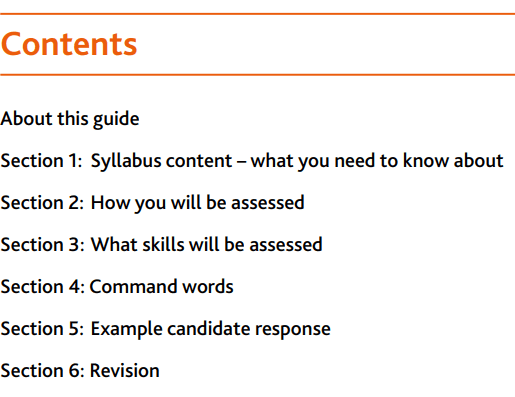

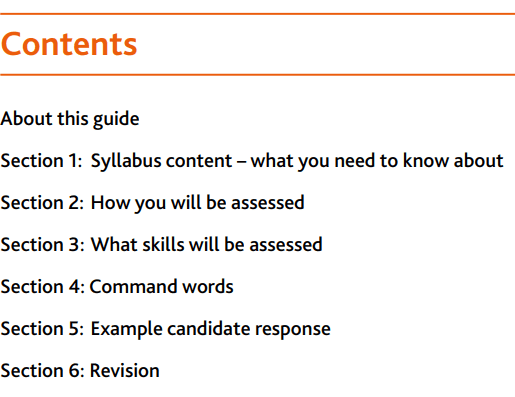

Here is a snapshot of what the document covers :

As you can see, reading through this document will give you a great deal of clarity of what is expected of you for IGCSE Accounting papers. Sadly, most students are not taught how to use the learner’s guide effectively.

B) IGCSE Accounting Syllabus

This document details what you need to know for each chapter. Unlike what your teachers have told you (shockingly and a tad bit pleasantly surprising), you do not have to mug the entire book.

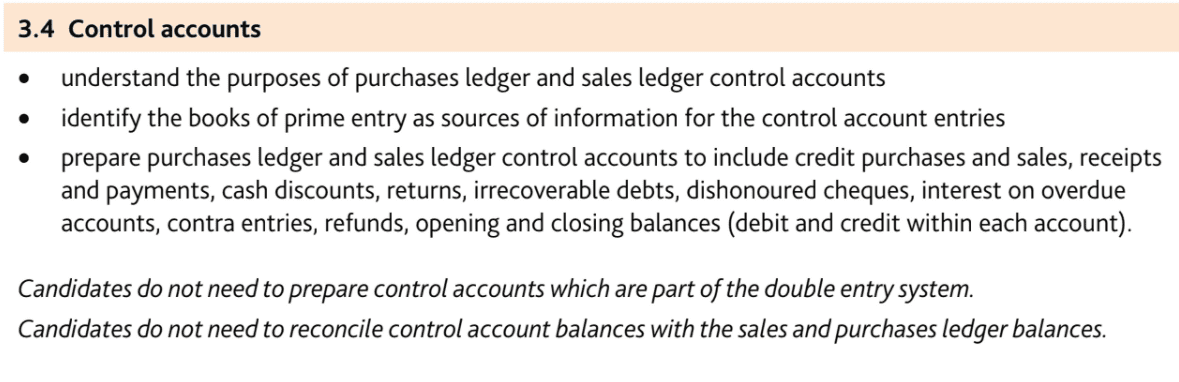

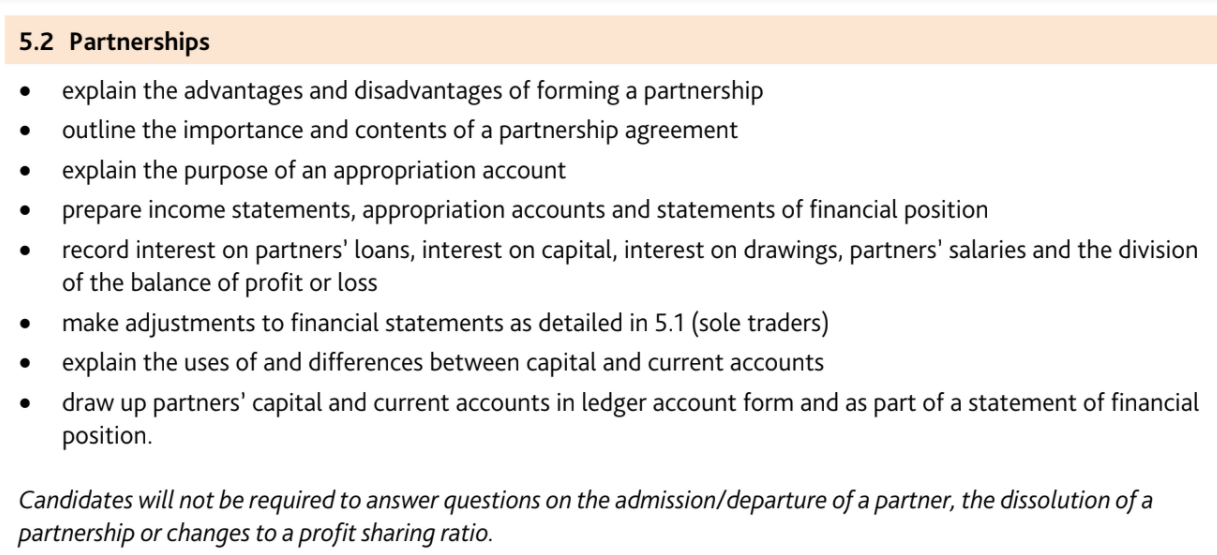

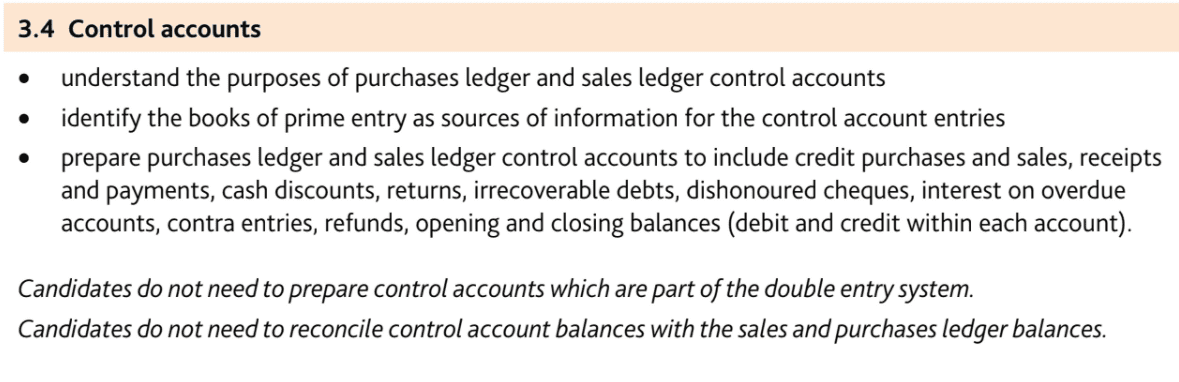

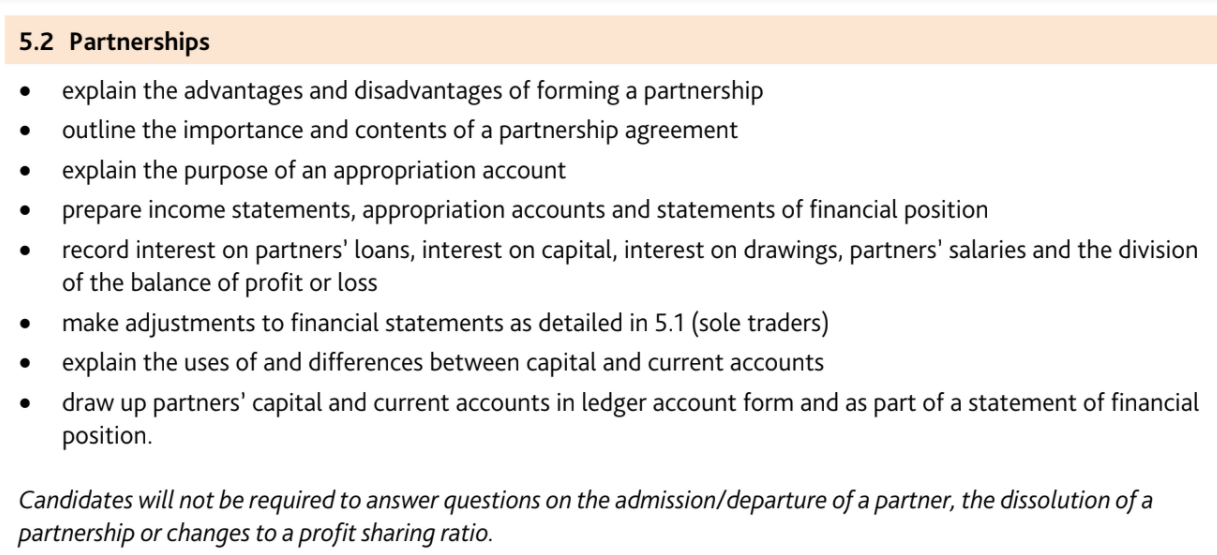

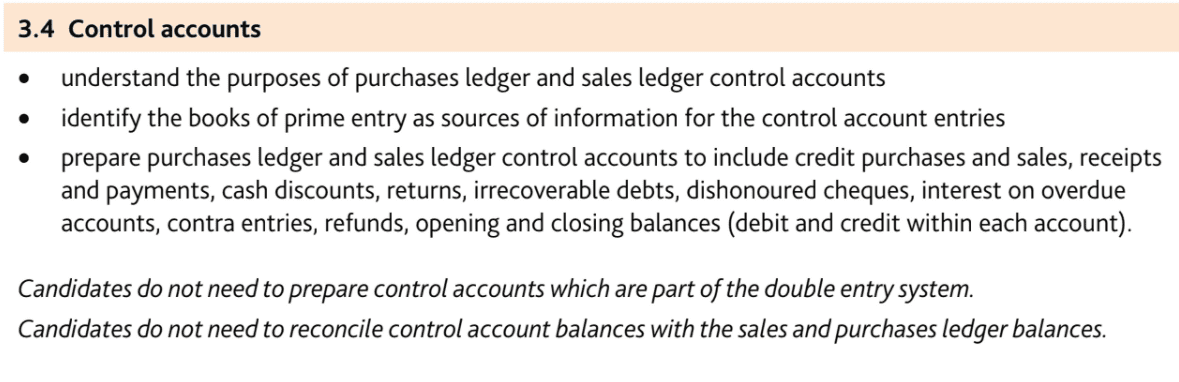

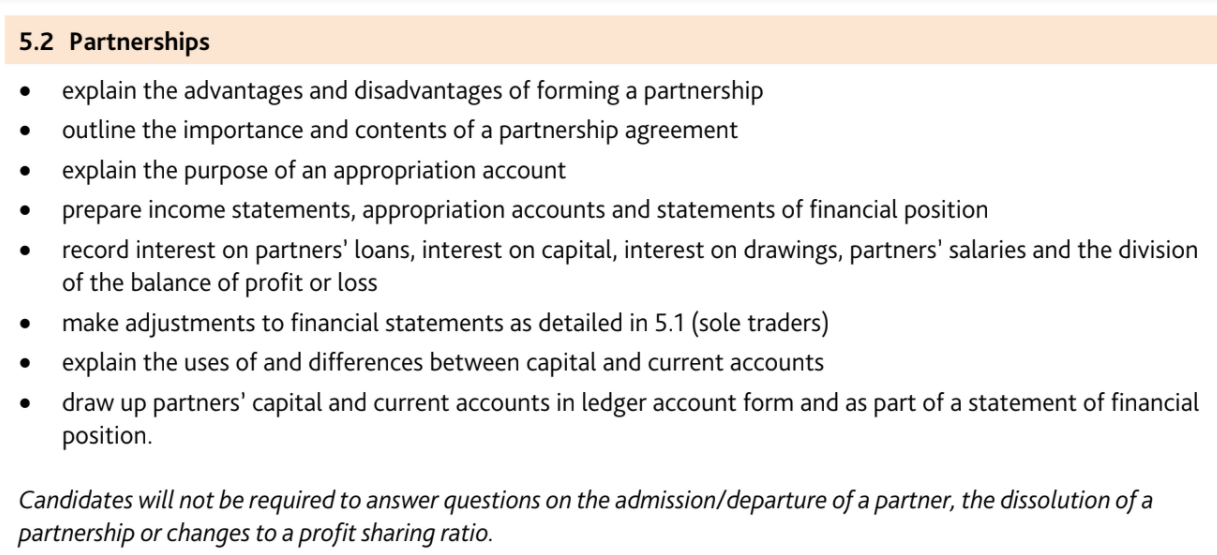

The syllabus is quite clear that you do not need to know or master certain things.

Here is a good example of CAIE clearly stating that you do not need to know certain things. Most teachers fail to refer to the syllabus and force students to study everything in the textbook, resulting in students getting both stressed and burned out.

Most importantly, as you can see from the excerpt above, CAIE requires you to demonstrate different skillset for different parts of the syllabus. There are certain things you only need to know how to outline and not explain in detail. Some items only require you to learn how to record whereas others require to have comprehensive knowledge that will enable you to make adjustments or draw up the accounts. Learning how to use the IGCSE Accounting syllabus booklet can have a significant impact on your exam results.

It is important that you are correctly guided by expert teachers to ensure your success in IGCSE Accounting exam papers. Inexperienced, rookie teachers can cause harm to your chances of securing excellent grades. If you are confused and would like to understand where you stand in terms of syllabus mastery, drop us a message to arrange for a subject-specific discovery session.

3. Know Thy Opponent

Anthony Horowitz put it aptly when he said, “You cannot defeat your enemies until you know who they are”. To conquer IGCSE Accounting and secure an A*, you must know in excruciating detail what the examiner requires of you.

In this section, we will cover everything you need to know about your “enemy” and defeat “him” as easily as a child breaks a toothpick. Here is what you must know :

A) Exam format, duration and mark allocation

B) Assessment objectives

C) Command words

D) Marking scheme

F) Examiner reports

As you can see, there are quite a bit of things you need to know inside out before you stand a fair chance of conquering the examiners’ fort.

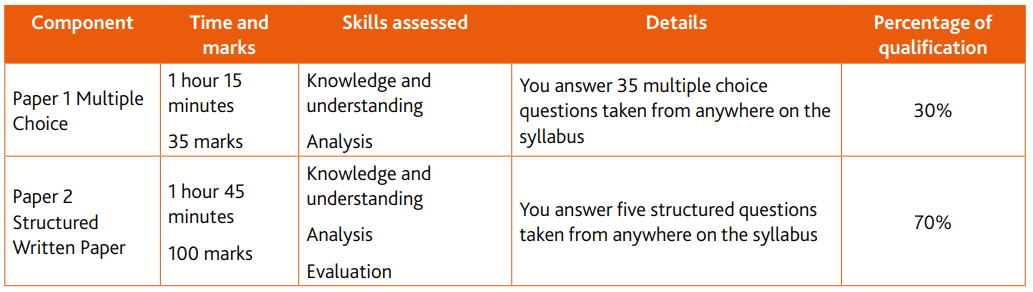

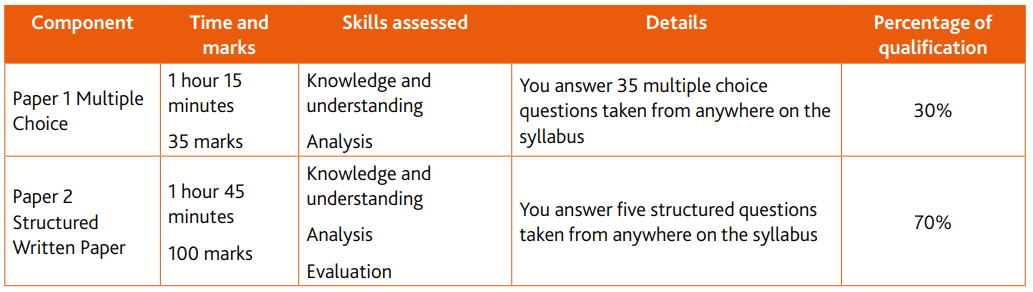

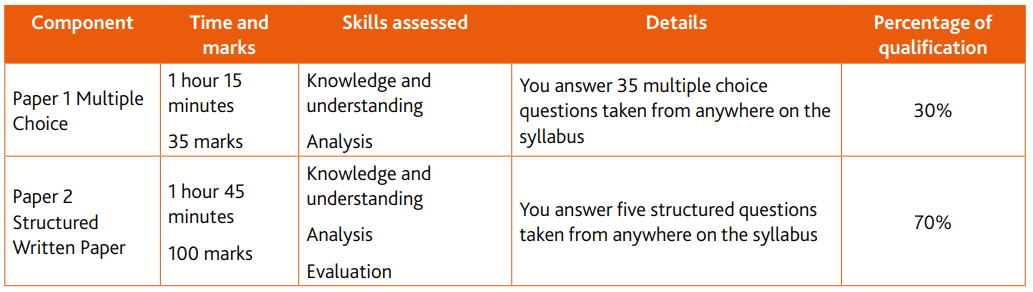

A) Exam format

It goes without saying a candidate must be extremely familiar with the exam format for IGCSE Accounting.

From the table above, it becomes rather obvious that you choose to ignore Paper 1 at your peril if you wish to score an A*. Even if you can score full marks for Paper 2, IGCSE Accounting A* will still be elusive to you if you fail to score at least half of the marks allocated in Paper 1.

You must also be able to tell from the table that you have 1.05 minutes for every mark allocated in Paper 2. That means you should not be spending more than 5.25 minutes on a 5 mark question. Spending more than the allocated time on each question means you are stealing marks away from other questions that you could easily score. Why do I say this? You need to understand the assessment objectives of CAIE to understand what I am saying.

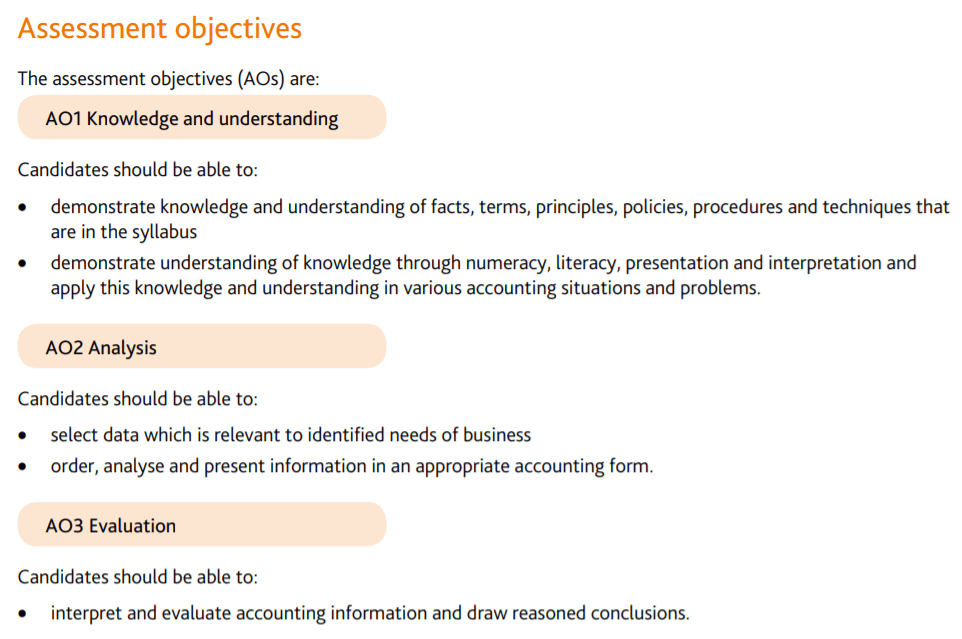

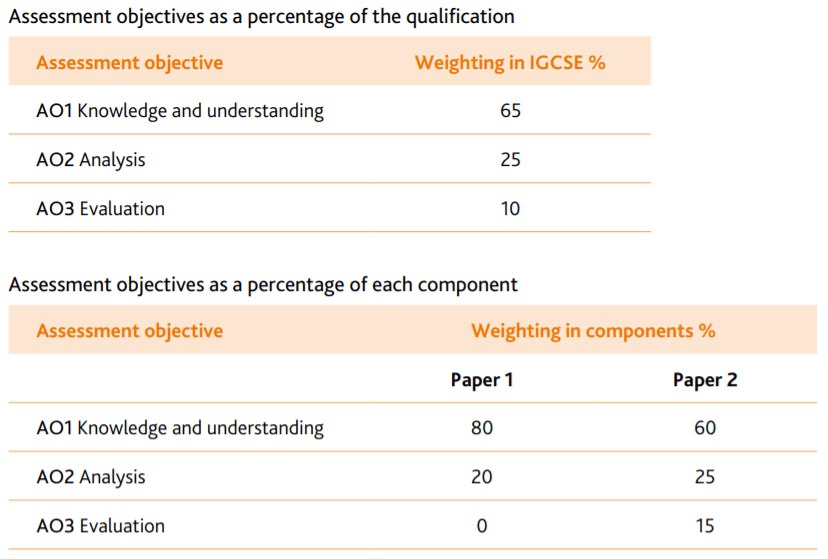

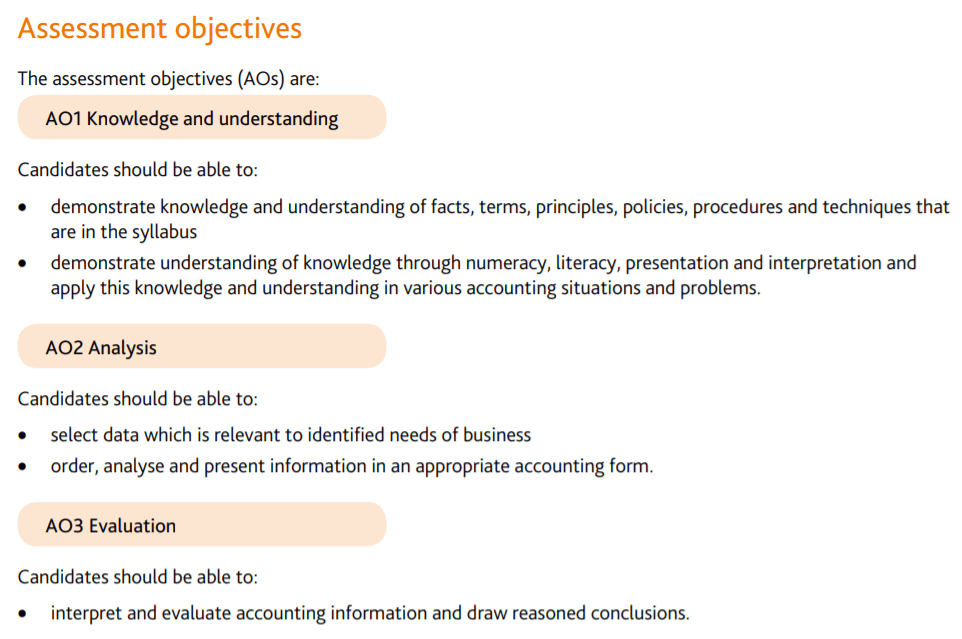

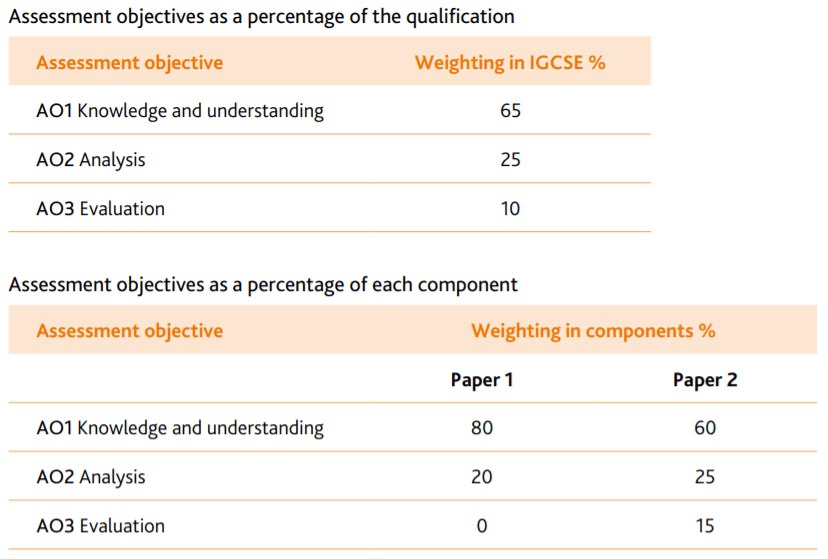

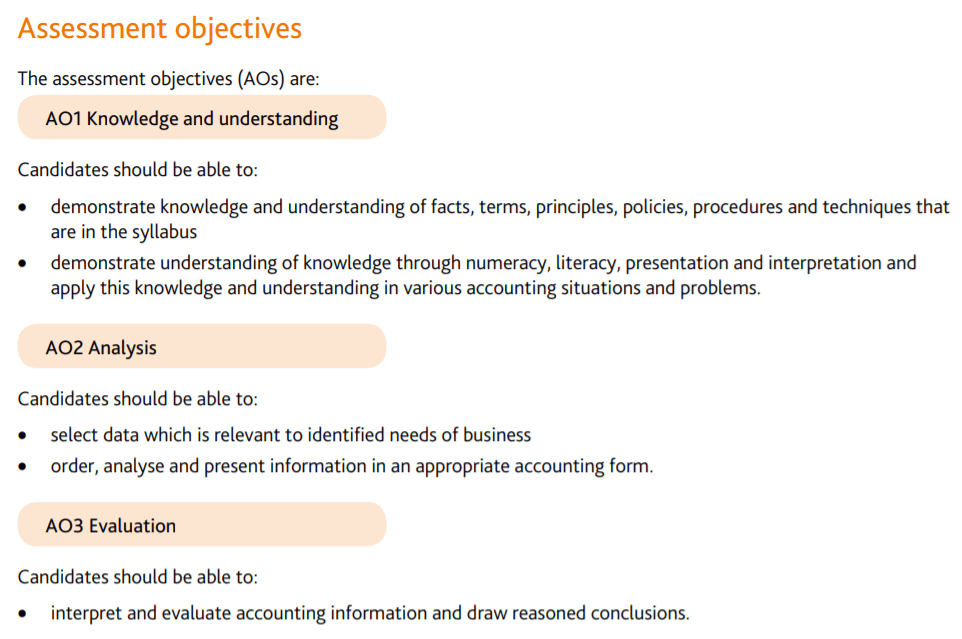

B) Assessment Objectives

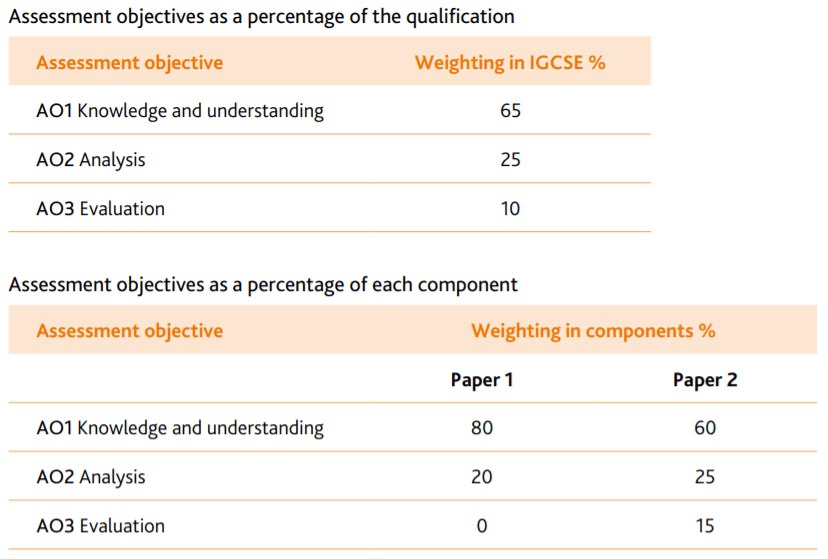

As you can see, the AO3 requires you to display a deeper understanding of the syllabus than AO1. The assessment objectives are not evenly distributed throughout the papers.

Here is how they are distributed in your IGCSE Accounting paper :

As you can see, 65% of your total marks is from AO1. This means 80 % of Paper 1 and 60% of Paper 2 for IGCSE Accounting are from the easiest assessment objective. When you do not follow the time allocated for each question, you end up sacrificing “easy marks”(from AO1) that are available in other questions.

If your teacher has never taught you these techniques and you need help before your exams then reach out to us for our IGCSE Accounting online tuition classes.

C) Command Words

Most teachers (and students) spend all their time mastering the syllabus and leave none to master the command words used by the IGCSE Accounting examiner. They do so at their peril.

The command words are how the examiner communicates with the candidate on what he/she expects out of an answer. For example, the command word, “Discuss” entails that you talk about both sides of the argument (advantages and disadvantages) and provide an answer that is structured (as well as depth). In contrast, the command word “Explain” only requires you to make the relationship between things evident by providing evidence. There are 25 command words for IGCSE Accounting. Each of them requires a specific action from the candidate.

For example, it might not be the most efficient use of time to write a whole paragraph on a question that tells you to just state the answer. You might think that this is obvious but according to the marking scheme and the IGCSE Accounting examiner report, this is where most mistakes are made.

To help you navigate the rather confusing list of command words, we’ve put together a video to explain each command word. You can check it out here.

D) Marking scheme

It is wise for you to know that Sun Tzu once said, “To know your enemy, you must become your enemy”. This can’t be more apt for IGCSE Accounting candidates. You must learn to see how the marking scheme is laid out so you can understand how the examiner will be marking your paper.

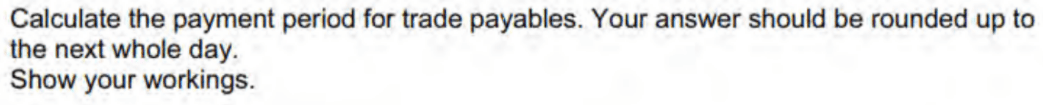

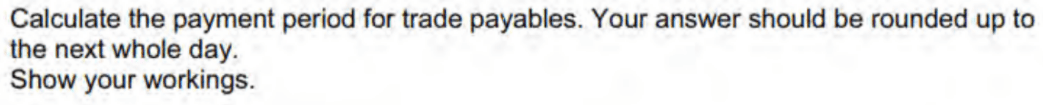

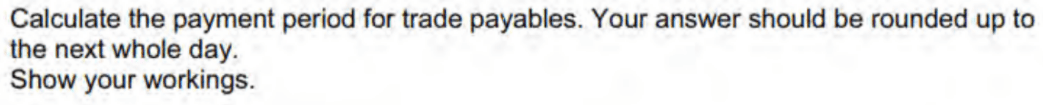

Let’s look at a simple example from a past year question. The question below carries 2 marks.

Here is how the examiner chose to award the 2 marks.

This means even if you calculated it correctly but without either showing the working only (but did not round off the number of days) or provided the answer as 46 days (without showing the working), you will not get the full mark for this question.

Of course, before you could peek into the marking scheme you must first practice the past year questions.

E) Past Year Questions

Any teacher worth their salt will tell you this: Practice your past year questions. However, most fail to add another important part: Do not depend on it or count on spotting trends. The IGCSE Accounting examiner is known to throw a surprise every now and then, leaving candidates shocked if all you’ve done is mug the past year papers. Use the past year papers as a guide on what to expect but continue to sharpen your analytical skills and “outside the box” thought process if you wish to face no hiccups during the IGCSE Accounting exam day.

It is also equally important that you DO NOT audit your answers while practicing them. This leads to a false sense of confidence which can ruin your exam results. It is best for you to time yourself while doing the papers and mark them objectively once you are done.

If you need assistance in preparing for your IGCSE Accounting papers, feel free to reach out to us for our online tuition classes.

F) Examiner report

Lastly, if you have the time, it would be highly beneficial to read a few examiner reports. The reports will give you an idea of where most mistakes are made and what are the common pitfalls among candidates. Having a clear idea of where others have succumbed before will help you avoid the same mistake. As Ken Schramm puts it, “A smart person learns from his mistakes, but a truly wise person learns from the mistakes of others.” You have the chance to be a truly wise person so be one.

Besides being wise, the report will provide you insight into what the examiner is expecting from each question making you truly read to take on IGCSE Accounting exam papers.

By mastering these three elements, namely your mindset, the syllabus and the exam requirements, you set yourself up for success from day one. You can also check out our detailed guide for :

- IGCSE Economics

- IGCSE Business Studies

- IGCSE Mathematics

- IGCSE English As Second Language

- And many more to help you ace your IGCSE

At Pasxcel, we’ve coached each and every one of the students to become a success story. If you need more help in your IGCSE, please drop us a message for online tuition classes or our IGCSE Ascension program.

Preparing for IGCSE Accounting paper can be a daunting task. More so since most teachers do not spend enough time ensuring the students master double entry before moving on to other topics. This fundamental flaw compounds the problem further when students are at lost with other topics.

It is understandable that in all the humanities subject, IGCSE Accounting has the highest drop rate. The most number of students get cold feet and drop the subject before the exam registration. How do you avoid the same situation from happening to you? I am going to share three things that you should do to guarantee your A*.

1. Mindset Transformation

First and foremost, you need to transform your mindset. You need to set clear and achievable goals based on the timeline in front of you. You need to start practicing the winner’s mindset. You need to be sure you are going to get this done, no matter how hard the going gets or how long it takes you to practice. Having this mentality alone can help you gain an insane amount of advantage in your preparations for IGCSE Accounting papers.

2. Syllabus Mastery

Next, you need to work on mastering the syllabus. For this, you would need to become familiar with two documents provided by Cambridge Assessment International Education (CAIE) for IGCE Accounting, namely :

A) IGCSE Accounting Learner’s Guide

B) IGCSE Accounting Syllabus

A) IGCSE Accounting Learner’s Guide

As the name suggests, this is a pivotal document that every IGCSE exam candidate must be introduced to at the beginning (the earlier, the better) of their IGCSE journey.

Here is a snapshot of what the document covers :

As you can see, reading through this document will give you a great deal of clarity of what is expected of you for IGCSE Accounting papers. Sadly, most students are not taught how to use the learner’s guide effectively.

B) IGCSE Accounting Syllabus

This document details what you need to know for each chapter. Unlike what your teachers have told you (shockingly and a tad bit pleasantly surprising), you do not have to mug the entire book.

The syllabus is quite clear that you do not need to know or master certain things.

Here is a good example of CAIE clearly stating that you do not need to know certain things. Most teachers fail to refer to the syllabus and force students to study everything in the textbook, resulting in students getting both stressed and burned out.

Most importantly, as you can see from the excerpt above, CAIE requires you to demonstrate different skillset for different parts of the syllabus. There are certain things you only need to know how to outline and not explain in detail. Some items only require you to learn how to record whereas others require to have comprehensive knowledge that will enable you to make adjustments or draw up the accounts. Learning how to use the IGCSE Accounting syllabus booklet can have a significant impact on your exam results.

It is important that you are correctly guided by expert teachers to ensure your success in IGCSE Accounting exam papers. Inexperienced, rookie teachers can cause harm to your chances of securing excellent grades. If you are confused and would like to understand where you stand in terms of syllabus mastery, drop us a message to arrange for a subject-specific discovery session.

3. Know Thy Opponent

Anthony Horowitz put it aptly when he said, “You cannot defeat your enemies until you know who they are”. To conquer IGCSE Accounting and secure an A*, you must know in excruciating detail what the examiner requires of you.

In this section, we will cover everything you need to know about your “enemy” and defeat “him” as easily as a child breaks a toothpick. Here is what you must know :

A) Exam format, duration and mark allocation

B) Assessment objectives

C) Command words

D) Marking scheme

F) Examiner reports

As you can see, there are quite a bit of things you need to know inside out before you stand a fair chance of conquering the examiners’ fort.

A) Exam format

It goes without saying a candidate must be extremely familiar with the exam format for IGCSE Accounting.

From the table above, it becomes rather obvious that you choose to ignore Paper 1 at your peril if you wish to score an A*. Even if you can score full marks for Paper 2, IGCSE Accounting A* will still be elusive to you if you fail to score at least half of the marks allocated in Paper 1.

You must also be able to tell from the table that you have 1.05 minutes for every mark allocated in Paper 2. That means you should not be spending more than 5.25 minutes on a 5 mark question. Spending more than the allocated time on each question means you are stealing marks away from other questions that you could easily score. Why do I say this? You need to understand the assessment objectives of CAIE to understand what I am saying.

B) Assessment Objectives

As you can see, the AO3 requires you to display a deeper understanding of the syllabus than AO1. The assessment objectives are not evenly distributed throughout the papers.

Here is how they are distributed in your IGCSE Accounting paper :

As you can see, 65% of your total marks is from AO1. This means 80 % of Paper 1 and 60% of Paper 2 for IGCSE Accounting are from the easiest assessment objective. When you do not follow the time allocated for each question, you end up sacrificing “easy marks”(from AO1) that are available in other questions.

If your teacher has never taught you these techniques and you need help before your exams then reach out to us for our IGCSE Accounting online tuition classes.

C) Command Words

Most teachers (and students) spend all their time mastering the syllabus and leave none to master the command words used by the IGCSE Accounting examiner. They do so at their peril.

The command words are how the examiner communicates with the candidate on what he/she expects out of an answer. For example, the command word, “Discuss” entails that you talk about both sides of the argument (advantages and disadvantages) and provide an answer that is structured (as well as depth). In contrast, the command word “Explain” only requires you to make the relationship between things evident by providing evidence. There are 25 command words for IGCSE Accounting. Each of them requires a specific action from the candidate.

For example, it might not be the most efficient use of time to write a whole paragraph on a question that tells you to just state the answer. You might think that this is obvious but according to the marking scheme and the IGCSE Accounting examiner report, this is where most mistakes are made.

To help you navigate the rather confusing list of command words, we’ve put together a video to explain each command word. You can check it out here.

D) Marking scheme

It is wise for you to know that Sun Tzu once said, “To know your enemy, you must become your enemy”. This can’t be more apt for IGCSE Accounting candidates. You must learn to see how the marking scheme is laid out so you can understand how the examiner will be marking your paper.

Let’s look at a simple example from a past year question. The question below carries 2 marks.

Here is how the examiner chose to award the 2 marks.

This means even if you calculated it correctly but without either showing the working only (but did not round off the number of days) or provided the answer as 46 days (without showing the working), you will not get the full mark for this question.

Of course, before you could peek into the marking scheme you must first practice the past year questions.

E) Past Year Questions

Any teacher worth their salt will tell you this: Practice your past year questions. However, most fail to add another important part: Do not depend on it or count on spotting trends. The IGCSE Accounting examiner is known to throw a surprise every now and then, leaving candidates shocked if all you’ve done is mug the past year papers. Use the past year papers as a guide on what to expect but continue to sharpen your analytical skills and “outside the box” thought process if you wish to face no hiccups during the IGCSE Accounting exam day.

It is also equally important that you DO NOT audit your answers while practicing them. This leads to a false sense of confidence which can ruin your exam results. It is best for you to time yourself while doing the papers and mark them objectively once you are done.

If you need assistance in preparing for your IGCSE Accounting papers, feel free to reach out to us for our online tuition classes.

F) Examiner report

Lastly, if you have the time, it would be highly beneficial to read a few examiner reports. The reports will give you an idea of where most mistakes are made and what are the common pitfalls among candidates. Having a clear idea of where others have succumbed before will help you avoid the same mistake. As Ken Schramm puts it, “A smart person learns from his mistakes, but a truly wise person learns from the mistakes of others.” You have the chance to be a truly wise person so be one.

Besides being wise, the report will provide you insight into what the examiner is expecting from each question making you truly read to take on IGCSE Accounting exam papers.

By mastering these three elements, namely your mindset, the syllabus and the exam requirements, you set yourself up for success from day one. You can also check out our detailed guide for :

- IGCSE Economics

- IGCSE Business Studies

- IGCSE Mathematics

- IGCSE English As Second Language

- And many more to help you ace your IGCSE

At Pasxcel, we’ve coached each and every one of the students to become a success story. If you need more help in your IGCSE, please drop us a message for online tuition classes or our IGCSE Ascension program.

Preparing for IGCSE Accounting paper can be a daunting task. More so since most teachers do not spend enough time ensuring the students master double entry before moving on to other topics. This fundamental flaw compounds the problem further when students are at lost with other topics.

It is understandable that in all the humanities subject, IGCSE Accounting has the highest drop rate. The most number of students get cold feet and drop the subject before the exam registration. How do you avoid the same situation from happening to you? I am going to share three things that you should do to guarantee your A*.

1. Mindset Transformation

First and foremost, you need to transform your mindset. You need to set clear and achievable goals based on the timeline in front of you. You need to start practicing the winner’s mindset. You need to be sure you are going to get this done, no matter how hard the going gets or how long it takes you to practice. Having this mentality alone can help you gain an insane amount of advantage in your preparations for IGCSE Accounting papers.

2. Syllabus Mastery

Next, you need to work on mastering the syllabus. For this, you would need to become familiar with two documents provided by Cambridge Assessment International Education (CAIE) for IGCE Accounting, namely :

A) IGCSE Accounting Learner’s Guide

B) IGCSE Accounting Syllabus

A) IGCSE Accounting Learner’s Guide

As the name suggests, this is a pivotal document that every IGCSE exam candidate must be introduced to at the beginning (the earlier, the better) of their IGCSE journey.

Here is a snapshot of what the document covers :

As you can see, reading through this document will give you a great deal of clarity of what is expected of you for IGCSE Accounting papers. Sadly, most students are not taught how to use the learner’s guide effectively.

B) IGCSE Accounting Syllabus

This document details what you need to know for each chapter. Unlike what your teachers have told you (shockingly and a tad bit pleasantly surprising), you do not have to mug the entire book.

The syllabus is quite clear that you do not need to know or master certain things.

Here is a good example of CAIE clearly stating that you do not need to know certain things. Most teachers fail to refer to the syllabus and force students to study everything in the textbook, resulting in students getting both stressed and burned out.

Most importantly, as you can see from the excerpt above, CAIE requires you to demonstrate different skillset for different parts of the syllabus. There are certain things you only need to know how to outline and not explain in detail. Some items only require you to learn how to record whereas others require to have comprehensive knowledge that will enable you to make adjustments or draw up the accounts. Learning how to use the IGCSE Accounting syllabus booklet can have a significant impact on your exam results.

It is important that you are correctly guided by expert teachers to ensure your success in IGCSE Accounting exam papers. Inexperienced, rookie teachers can cause harm to your chances of securing excellent grades. If you are confused and would like to understand where you stand in terms of syllabus mastery, drop us a message to arrange for a subject-specific discovery session.

3. Know Thy Opponent

Anthony Horowitz put it aptly when he said, “You cannot defeat your enemies until you know who they are”. To conquer IGCSE Accounting and secure an A*, you must know in excruciating detail what the examiner requires of you.

In this section, we will cover everything you need to know about your “enemy” and defeat “him” as easily as a child breaks a toothpick. Here is what you must know :

A) Exam format, duration and mark allocation

B) Assessment objectives

C) Command words

D) Marking scheme

F) Examiner reports

As you can see, there are quite a bit of things you need to know inside out before you stand a fair chance of conquering the examiners’ fort.

A) Exam format

It goes without saying a candidate must be extremely familiar with the exam format for IGCSE Accounting.

From the table above, it becomes rather obvious that you choose to ignore Paper 1 at your peril if you wish to score an A*. Even if you can score full marks for Paper 2, IGCSE Accounting A* will still be elusive to you if you fail to score at least half of the marks allocated in Paper 1.

You must also be able to tell from the table that you have 1.05 minutes for every mark allocated in Paper 2. That means you should not be spending more than 5.25 minutes on a 5 mark question. Spending more than the allocated time on each question means you are stealing marks away from other questions that you could easily score. Why do I say this? You need to understand the assessment objectives of CAIE to understand what I am saying.

B) Assessment Objectives

As you can see, the AO3 requires you to display a deeper understanding of the syllabus than AO1. The assessment objectives are not evenly distributed throughout the papers.

Here is how they are distributed in your IGCSE Accounting paper :

As you can see, 65% of your total marks is from AO1. This means 80 % of Paper 1 and 60% of Paper 2 for IGCSE Accounting are from the easiest assessment objective. When you do not follow the time allocated for each question, you end up sacrificing “easy marks”(from AO1) that are available in other questions.

If your teacher has never taught you these techniques and you need help before your exams then reach out to us for our IGCSE Accounting online tuition classes.

C) Command Words

Most teachers (and students) spend all their time mastering the syllabus and leave none to master the command words used by the IGCSE Accounting examiner. They do so at their peril.

The command words are how the examiner communicates with the candidate on what he/she expects out of an answer. For example, the command word, “Discuss” entails that you talk about both sides of the argument (advantages and disadvantages) and provide an answer that is structured (as well as depth). In contrast, the command word “Explain” only requires you to make the relationship between things evident by providing evidence. There are 25 command words for IGCSE Accounting. Each of them requires a specific action from the candidate.

For example, it might not be the most efficient use of time to write a whole paragraph on a question that tells you to just state the answer. You might think that this is obvious but according to the marking scheme and the IGCSE Accounting examiner report, this is where most mistakes are made.

To help you navigate the rather confusing list of command words, we’ve put together a video to explain each command word. You can check it out here.

D) Marking scheme

It is wise for you to know that Sun Tzu once said, “To know your enemy, you must become your enemy”. This can’t be more apt for IGCSE Accounting candidates. You must learn to see how the marking scheme is laid out so you can understand how the examiner will be marking your paper.

Let’s look at a simple example from a past year question. The question below carries 2 marks.

Here is how the examiner chose to award the 2 marks.

This means even if you calculated it correctly but without either showing the working only (but did not round off the number of days) or provided the answer as 46 days (without showing the working), you will not get the full mark for this question.

Of course, before you could peek into the marking scheme you must first practice the past year questions.

E) Past Year Questions

Any teacher worth their salt will tell you this: Practice your past year questions. However, most fail to add another important part: Do not depend on it or count on spotting trends. The IGCSE Accounting examiner is known to throw a surprise every now and then, leaving candidates shocked if all you’ve done is mug the past year papers. Use the past year papers as a guide on what to expect but continue to sharpen your analytical skills and “outside the box” thought process if you wish to face no hiccups during the IGCSE Accounting exam day.

It is also equally important that you DO NOT audit your answers while practicing them. This leads to a false sense of confidence which can ruin your exam results. It is best for you to time yourself while doing the papers and mark them objectively once you are done.

If you need assistance in preparing for your IGCSE Accounting papers, feel free to reach out to us for our online tuition classes.

F) Examiner report

Lastly, if you have the time, it would be highly beneficial to read a few examiner reports. The reports will give you an idea of where most mistakes are made and what are the common pitfalls among candidates. Having a clear idea of where others have succumbed before will help you avoid the same mistake. As Ken Schramm puts it, “A smart person learns from his mistakes, but a truly wise person learns from the mistakes of others.” You have the chance to be a truly wise person so be one.

Besides being wise, the report will provide you insight into what the examiner is expecting from each question making you truly read to take on IGCSE Accounting exam papers.

By mastering these three elements, namely your mindset, the syllabus and the exam requirements, you set yourself up for success from day one. You can also check out our detailed guide for :

- IGCSE Economics

- IGCSE Business Studies

- IGCSE Mathematics

- IGCSE English As Second Language

- And many more to help you ace your IGCSE

At Pasxcel, we’ve coached each and every one of the students to become a success story. If you need more help in your IGCSE, please drop us a message for online tuition classes or our IGCSE Ascension program.

Accounting, Business Studies, Economics & Financial Literacy

BA(Hons) Finance, Accounting & Management, Sunway University

Chartered Accountant, ACCA.

Yuventhiran Nadarajan is a father, husband, speaker and entrepreneur. But he is best known among students and parents alike as an educator. Teacher Yuven believes that the current schooling system is outdated beyond measure and is the last piece of surviving antiquity in our fast-paced ever-changing world.